By Chew Yu Xuan, Scott Koh, and Grace Ong (Year 12 MarComm interns)

Let’s start off with a seemingly simple question:

What is wealth?

For some of us, we may picture a big house, expensive cars, and massive yachts; or designer bags, luxury watches and stunning jewellery; or exotic holidays, lavish parties and so on. When we think of wealth, we often think of the lavish and extravagant lifestyles of the rich, the class with the highest paying jobs and a seemingly endless display of money.

But the truth is, what some of us may fail to understand is that wealth is not measured by the extravagant or expensive things you have in life, or how high of an income you earn, and having such a mind-set will never enable us to appreciate the real value of learning to save and spend money wisely.

As students begin to age and mature into young adults, parents may begin to entrust them with more money, therefore, it becomes increasingly important to help your child build a responsible understanding of financial literacy. Firstly, by having them understand that:

Wealth is not measured by how much you earn or by what you have but by how much you keep, or in other words, wealth is the difference ween how much you earn and how much you spend.

WEALTH = WHAT YOU EARN – WHAT YOU SPEND

Even if you make a lot of money, if at the end of the day, you spend it all, you’ll inevitably always end up with nothing, or even worse, digging yourself a hole of debt.

So, how do we avoid developing these bad habits? Quite simply, by developing good habits of saving and spending instead.

For almost everything in life, when we want to make a decision no matter how important it is, we require data. We want to get as much information as possible first, analyse them, and then based on the data and analysis, make a decision that we believe is best. Generally, the more data that we have, it correlates to a more well-informed decision. A money diary is where you get the data.

Teaching a child to keep a money diary:

- gives a ter picture and understand how much money was spent in that month, and whether or not they should spend more or save it

- offers a simple visualisation tool, especially for younger children to grasp the concept of money, and is a terrific way for them to start getting exposed and even excited about the financial world

- shows them how much they spent and saved for the month, and how much they have left – in general, especially for older children, it helps them keep track of their money and clearly shows if they need to make ter decisions on spending and saving.

- illustrates clearly the spending patterns – create categories such as food, education, transportation, etc. to have a clearer picture of where the money is going to

- introduces them to planning for the long-term; we should not purchase things based on our intuition and should always rely on a plan

Is just teaching children to put money in a piggy bank enough? For toddlers, maybe, but for teenagers we think it is important to also highlight the importance of savings, and not just the act of savings. Lessons or real life scenarios from this pandemic can serve as good examples as to why it is important to have savings and the different ways one can save, prompting them to think critically on the best ways that they can start saving from an early age.

Is just teaching children to put money in a piggy bank enough? For toddlers, maybe, but for teenagers we think it is important to also highlight the importance of savings, and not just the act of savings. Lessons or real life scenarios from this pandemic can serve as good examples as to why it is important to have savings and the different ways one can save, prompting them to think critically on the best ways that they can start saving from an early age.

As for teenagers, it would be good delve a little deeper into money management to help them understand:

- financial investment, the benefits of understanding more about savings now will return to you in the long run.

- various types of savings accounts/plans that banks usually offer

- difference ween putting your money into a savings account and investing it

- possible ways of saving and the types of returns you can get from each of them

– your adult children will definitely thank you for getting them started on the right path.

Now strap in, because we’re about to dive deeper into things we wished our parents taught us about spending and saving money.

Have you ever encountered situations where you thought you had all your expenses in control, but when it came to your actual spending, it exceeded your budget?

Have you ever encountered situations where you thought you had all your expenses in control, but when it came to your actual spending, it exceeded your budget?

Budgeting is so important in our daily lives, to make sure we can handle and predict our future spending plan and keep us out of debt. Creating a budget plan that outlines your spending is relatively easy. Adhering to a realistic budget plan can be challenging as it not only requires financial discipline, you also need to make sensible estimates of your spending.

Learning from a young age about realistic budgeting, and having hands-on experience with real life situations, like grocery shopping or back-to-school shopping, helps expose you to a good knowledge of sensible spending and budgeting. The accumulation of all these practical experiences will train you to become a pragmatic spender in the future. Practice makes perfect!

Does your child have a habit of buying something trendy just because his/her peers bought them? Do they ever spend excessively on clothes, stationeries, electronic devices, and more, just to not feel left out, only to leave it aside months later when they realise that they no longer need those things?

Does your child have a habit of buying something trendy just because his/her peers bought them? Do they ever spend excessively on clothes, stationeries, electronic devices, and more, just to not feel left out, only to leave it aside months later when they realise that they no longer need those things?

The fear of missing out (FOMO) is so common in our daily lives and can have a significant effect when it comes to spending. Trying to keep up with friends’ lifestyles may seem like one of the biggest things in our life growing up as our vision is relatively short-sighted. To a child, the latest toy/game/merchandise available (and those which our friends have) automatically become an “I want” and “I need”.

FOMO often results in impulse buying, and the best way to counter this is implementing some delayed gratification. Whenever you want to buy something, write it down, make a list, and come back to it a week later – it really helps you to re-evaluate the significance of the items, and you will probably find that you didn’t really want it in the first place.

As a student, the thought of retirement has most likely never crossed your mind. The question that many may ask is, “Would starting to save now even make a difference in the long run?”

As a student, the thought of retirement has most likely never crossed your mind. The question that many may ask is, “Would starting to save now even make a difference in the long run?”

Unfortunately, failing to plan for retirement is a mistake which many past generations have regretfully made, and it has made many miserable, creating a lot of financial problems for them later on in life after they’ve stopped working. Therefore, it’s essential we practise the skills, develop the habits and educate ourselves on the importance of planning for retirement now, so we can avoid making the same mistakes as those before us.

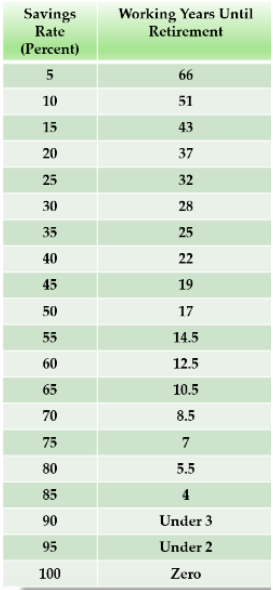

In the simplest nutshell, the principle to retirement is this: you have the ability to decide when you wish to retire. It all depends on one simple ingredient – your savings rate. It is simple maths, the more money you save now, the more time your money will have to grow exponentially, thanks to the power of compound interest.

That being said, besides time, compound interest works even ter when you commit to a high savings rate as a percentage of your income. The higher your savings rate, the faster your money grows, and the closer you are to retirement. For example, a savings rate of 20% would allow you to retire after 37 years of working, but a savings rate of 70% would reduce this to just 8.5 years.

This relationship can even be summarised by this table.

(Credits to the Mr Money Moustache blog for these charts. You can find out more about this at mrmoneymoustache.com)

Conclusion

As kids, there’s a hurry to grow up and finally be able to gain independence and be free to do all of the amazing and wild things that real adults can. Like getting your license, or travelling to foreign countries, or going to university, or of course…getting a job and being able to earn and spend your own money.

But as always, like many things in life, with great power comes great responsibility, and so building good financial practices at an early age, like the ones discussed here today – creating a realistic budget, keeping track of and controlling spending, and making consistent savings, will allow us to live comfortably and build a financially secure future… for us and our future loved ones.